In the world of macro trading, the "consensus estimate" is often just a noise floor—a median of analyst guesses that rarely captures the nuance of the real economy. For hedge funds and proprietary trading desks, the edge doesn't come from following the consensus; it comes from knowing when the consensus is wrong.

At Superset, we have built a proprietary machine learning architecture designed to solve one specific, high-value problem: Predicting Month-over-Month (MoM) US Retail Sales.

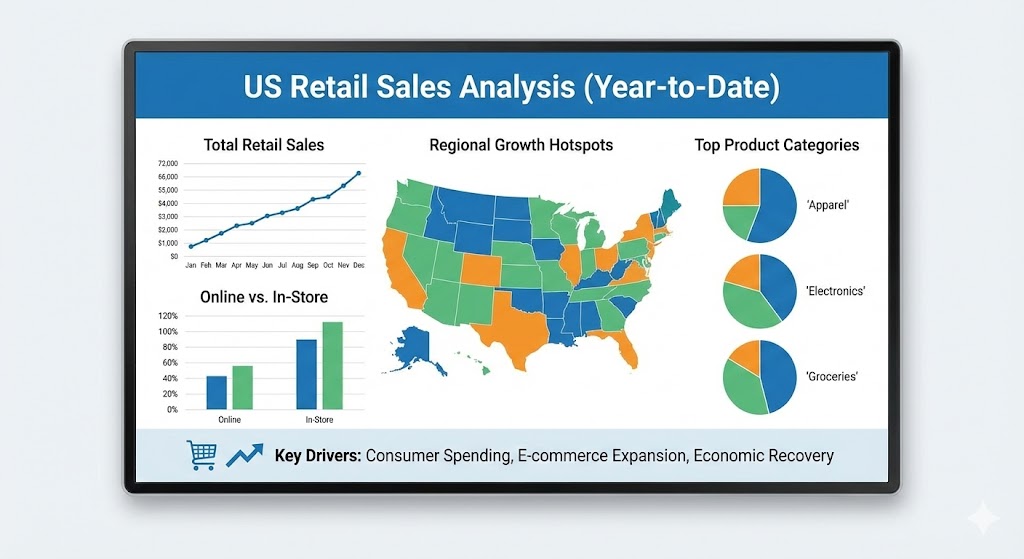

Why Retail Sales? Because consumer spending accounts for nearly 70% of US GDP. It is the pulse of the economy, a primary driver of inflation expectations, and a massive volatility event for equities, FX, and Treasuries.

The Data Advantage

We don't rely on sentiment surveys or alternative data proxies alone. Our model is rigorously trained on fundamental data directly from the Federal Reserve and US economic departments.

By ingesting, cleaning, and feature-engineering over a decade of monthly releases, our system identifies non-linear relationships between disparate economic indicators that traditional linear regression models miss.

Performance Metrics: The Numbers That Matter

We understand that institutional clients require backtested proof, not marketing fluff. Here is how our model has performed against the actual print over a 10-year out-of-sample backtest:

The Headline Stat: Our model predicts MoM retail sales changes to within ±1% accuracy for 84.8% of all data points over the last decade.

Key Performance Indicators:

| Metric | Value |

|---|---|

| Mean Error | 0.38% |

| Accuracy Rate | 84.8% |

| Test Period | 2016-2025 |

| Data Points | 116 months |

In a game where missing the print by 50 basis points can trigger an algorithmic sell-off, a Mean Error of just 0.38% represents a significant informational advantage.

How Traders Deploy This Signal

This isn't just academic data; it is actionable intelligence. Here is how our current beta partners are utilizing this signal:

1. Front-Running the Release

Position ahead of the official 8:30 AM EST release when our model diverges significantly from the Bloomberg consensus.

2. Risk Management

Tighten stops or hedge exposure if our model predicts a volatility-inducing outlier number.

3. Thesis Validation

Confirm or reject discretionary macro views on consumer health with a quantitative confidence interval.

The Bottom Line

Market efficiency is a myth when it comes to complex macro data. There is signal in the noise, but you need the right architecture to extract it.

We are currently opening a limited number of seats for our API and dashboard access. If you are looking to add a quantitative edge to your macro strategy, let's talk numbers.

Want to Learn More?

If you're interested in accessing our retail sales predictions:

- Check out our Marketplace to see the Retail Spending Predictor

- Contact us at support@superset.ai

- Sign up to get started with Superset